With nearly 45 years of experience in the grocery industry, Gary Huddleston, a grocery industry consultant for the Texas Retailers Association (TRA), provides key insights into Texas’ grocery market, including economic trends, legislative concerns, and industry challenges.

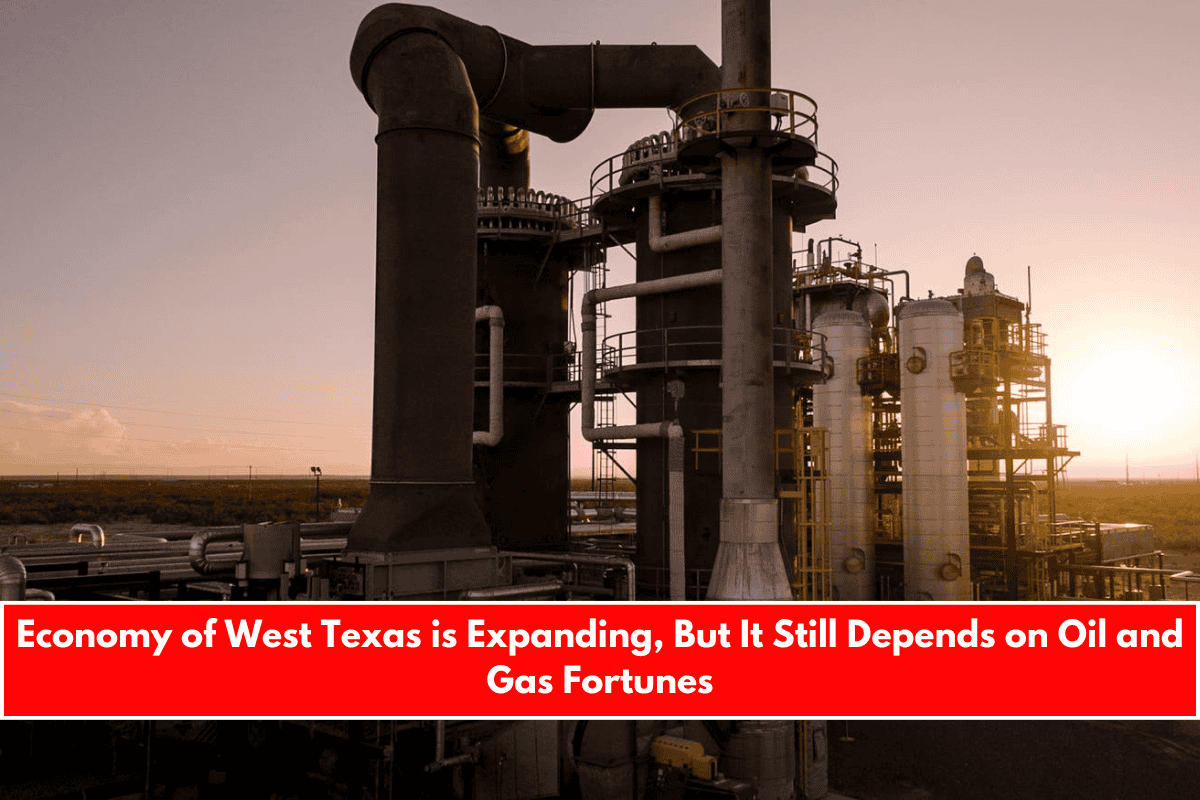

West Texas Grocery Market Insights

The grocery market in West Texas is closely tied to the health of the oil, gas, and ranching industries. The Lubbock and Amarillo regions continue to experience economic growth, leading to a competitive grocery landscape.

Key Market Trends:

- Major players like Walmart, H-E-B, Costco, and United dominate the market.

- E-commerce continues to expand, with curbside pickup and home delivery growing.

- Amazon is a key competitor in grocery delivery.

- Grocery distribution has improved, though West Texas lacks major hubs like Houston or Dallas.

- Fluctuations in the oil and gas market impact both grocery sales and labor availability.

Texas Economy & Grocery Industry Growth

Texas remains a booming state, with over 612,000 families moving in last year. This population increase boosts grocery sales, but employment remains a challenge as grocers struggle to find and retain qualified workers.

Many individuals start their careers in grocery stores, with opportunities for scholarships and advancement.

Grocers’ Outlook on the New Presidential Administration

The grocery industry is optimistic about the new administration’s stance on reducing business regulations, especially concerning:

- Refrigeration requirements, which are one of the biggest expenses for grocers.

- Food traceability rules set to be implemented next year.

- Credit card processing fees, which continue to rise as sales increase.

Immigration and tariff policies remain uncertain, but Texas grocers are watching closely for potential impacts.

Overall Health of the Texas Grocery Industry

The Texas grocery industry is thriving, with many grocers enhancing customer experiences through:

- Loyalty programs tied to fuel rewards and digital coupons.

- Expanded in-store offerings, such as pharmacies, sushi bars, in-store dining, Starbucks kiosks, and juice bars.

- A focus on local products, especially Texas-grown produce and well-known brands like Blue Bell Ice Cream.

- Increased nutrition labeling, including gluten-free product tags.

- A shift away from traditional newspaper flyers to social media promotions.

Grocery Store Growth & Expansions

Texas continues to see growth in grocery store numbers, with no signs of decline.

Notable Expansion: WinCo is entering the Wichita Falls market, with an 84,000-square-foot store expected to open in late summer or early fall.

Additionally, grocers are investing heavily in store remodels, with costs rising from $750,000 five years ago to $4-8 million today.

Technology in Grocery Retail:

- Self-checkout lanes are expanding.

- Robotics are being used in distribution centers.

- AI-powered call centers are improving customer service.

SNAP and WIC sales are up 10% compared to last year, with over 23,000 grocers accepting SNAP and 3,000 accepting WIC, totaling $700 million in monthly sales.

Top Challenges for Texas Grocers in 2025

1. Organized Retail Crime

Retail theft remains a major concern, with grocers working alongside the Texas Organized Crime Prevention group to prevent fraud, including:

- Gift card fraud, which continues to grow.

- Efforts to apprehend and convict organized crime groups targeting retailers.

2. Rising Credit Card Fees

Grocers are pushing for legislative action to reduce fees, especially since they pay credit card processing fees on sales tax collected for the state.

3. Inventory Tax Issues

Grocers must pay taxes on inventory, including perishable products like milk, produce, and bakery items, which may not sell before tax time.

4. Alcohol Sales Restrictions

Texas grocers can sell beer and wine, but they cannot sell ready-to-drink alcoholic beverages like High Noon or Captain Morgan Spiced due to state regulations. TRA is working with the Texas Alcoholic Beverage Commission to push for changes.

Key Legislative Concerns for Texas Grocers

TRA Supports:

- Keeping SNAP customers’ freedom of choice in grocery purchases.

- Voluntary recycling programs for plastic bags and bottles rather than mandatory regulations.

- Nutrition labeling to help customers make informed decisions.

TRA Opposes:

- Any new restrictions on SNAP benefits that would limit customer choices.

- State-specific food labeling laws, which complicate nationwide distribution.

Leave a Reply