With Tax Season 2025 open since January and thousands of US citizens already receiving their tax refunds in their checking accounts, many citizens are wondering what happened to their IRS tax refund.

When we consider that US citizens have access to this information, calculating when they will have the money becomes much easier.

Regardless, it is critical to keep this information up to date at all times, as knowing the status of our Tax Refund is just as important as sending all required documentation on time. In any case, it is critical to have as much information as possible, regardless of our current circumstances.

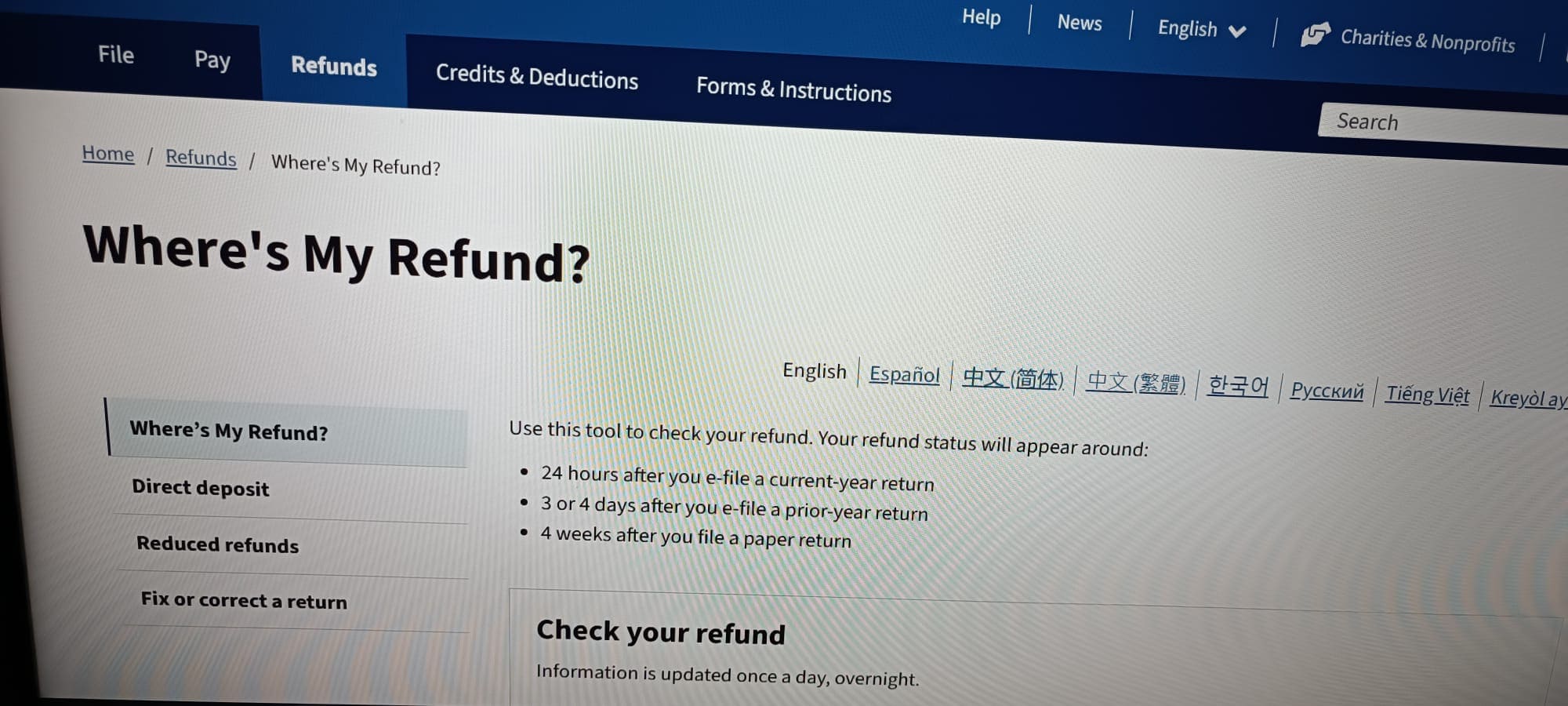

How can I check where is my refund?

The truth is that finding out where my refund is is far easier than it appears. We will be able to access the tool that will assist us in finding all of the available information via the official IRS website. When we enter the website, we must enter information about our 2024 tax return.

This information is simple to find because we only need to enter our Social Security number (or ITIN; either is valid), filing status, and refund amount. We will be able to see all of the information available so far, but we may not be able to learn much more than we already know.

So, thanks to this, we may be able to learn more about it, but we will have to wait until the IRS sends the Direct Deposit to our current accounts.

When does the IRS send the Tax Refund?

The truth is that there is no set date for sending the Tax Refund money, but there is an estimated date. In this regard, we can expect to receive the Tax Refund approximately three weeks after submitting the Tax Return to the IRS, though this is dependent on a number of factors.

To receive our Tax Refund as soon as possible, we must:

- Have sent the Tax Return soon.

- Have sent the documentation to the IRS electronically.

- Having sent all the documentation correctly.

- Having the right to a Tax Refund.

Remember that even if our calculations indicate that we will receive a Tax Refund payment when we submit the Tax Return documents, the truth is that everything is directly dependent on whether we are actually eligible for the Tax Refund.

Regardless, it is customary to wait approximately three weeks after we send the Tax Return. However, if we are not eligible or do not select Direct Deposit as the collection method, we may have to wait a little longer.

Leave a Reply