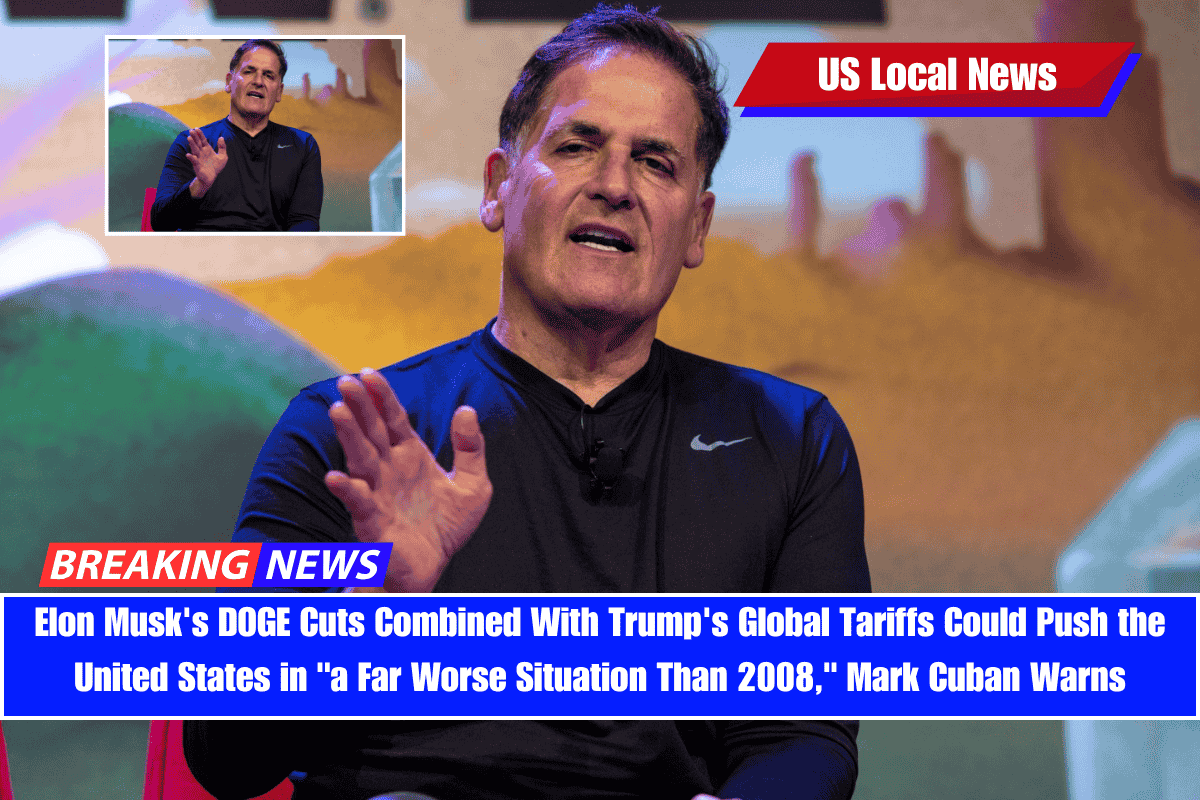

Billionaire entrepreneur Mark Cuban has raised serious concerns about the long-term impact of President Donald Trump’s new tariff policies and federal workforce cuts by DOGE (Department of Government Efficiency).

In a series of posts on Bluesky, Cuban warned that the U.S. could be heading toward an economic situation “far worse than the 2008 financial crisis” if these policies remain unchanged.

His remarks come at a time when global markets are already reacting negatively, with Asian markets experiencing historic losses following Trump’s latest economic moves.

Mark Cuban: “We Could Be in Big Trouble”

Cuban didn’t hold back in his criticism. He said the combination of massive tariffs and sharp cuts to the federal workforce—pushed by Elon Musk’s DOGE—could cause severe and long-lasting economic damage.

“If the new tariffs stay in place for multiple years and are inflationary, and DOGE continues to cut and fire, we will be in a far worse situation than 2008,” Cuban wrote.

His message was clear: if the current policies continue unchecked, they could hurt businesses, kill jobs, and trigger a deep economic slowdown.

Trump’s New Tariff Policy: What Changed?

Last week, the Trump administration announced sweeping new tariffs, ranging from 10% to 50%, on goods imported from nearly 90 countries. These tariffs apply to both allies and competitors, affecting everything from electronics to automobiles.

Trump defended the decision, saying it’s part of his plan to bring back American manufacturing and jobs.

“Sometimes you have to take medicine to fix something,” Trump told reporters, adding that the U.S. has “all the advantages.”

But these announcements have spooked investors, with many fearing a trade war and global recession.

Global Markets in Freefall

Markets in Asia saw some of their worst single-day losses in years on Monday:

- Hong Kong’s Hang Seng Index dropped 13.2%, the biggest crash since 1997

- Tencent fell 12.5%

- Lenovo collapsed by 22.9%, becoming the worst performer in the Global 500

Analysts say this reflects a loss of investor confidence in global trade stability, especially in the tech sector.

Bill Ackman Joins the Chorus of Concern

Mark Cuban isn’t the only billionaire speaking out. Bill Ackman, CEO of Pershing Square Capital, also issued a warning. He called Trump’s trade strategy a “self-inflicted economic nuclear winter.”

“Business runs on confidence, and the president is rapidly losing the trust of global business leaders,” Ackman said on X (formerly Twitter).

He also stressed that low-income Americans—already struggling with inflation—will be hit the hardest.

Cuban’s Solution: Pause and Plan

Cuban believes there is a way to avoid disaster. He suggests:

- Keeping only the minimum 10% global tariff

- Phasing DOGE’s cuts to the federal workforce over three years

- Reducing interest rates to keep debt manageable

“That slows the economy, reduces rates, and keeps debt payments affordable,” Cuban said.

Cuban also warned that DOGE’s approach to cost-cutting could indirectly impact Social Security and other vital services.

Leave a Reply