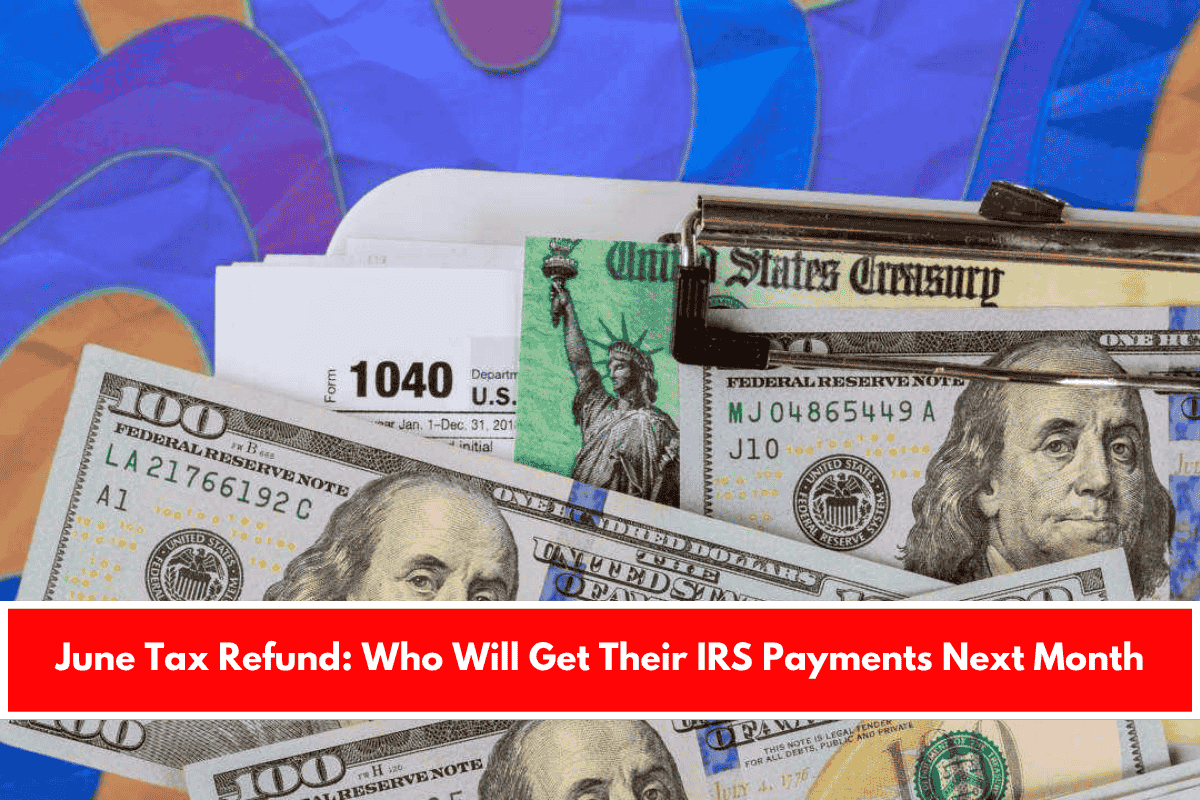

If you missed the April 15 deadline to file your tax return, don’t worry—you might still have a refund waiting for you. Many taxpayers think that filing late means losing their money, but in many cases, the IRS allows you to claim your refund up to three years after the original deadline. If you’re one of those who filed late or are planning to, here’s what you need to know about tax refunds in June 2025.

Who Will Get Tax Refunds in June 2025?

Taxpayers who filed electronic tax returns between May 4 and May 11, 2025, can expect their refunds to arrive between May 26 and May 31. These dates apply only if the return is accurate and the taxpayer selected direct deposit.

If you filed your return after May 11, you’ll likely receive your refund in early to mid-June. For example, if your return was accepted on May 12, your refund may arrive between June 2 and June 6. These dates can vary depending on your bank’s processing time.

Those who mailed paper returns or are expecting physical checks may need to wait between 4 to 8 weeks for processing. If your return includes special credits like the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), there may be additional delays due to extra verification steps.

People living in natural disaster areas, such as parts of Arkansas, may also see delays in June because of special IRS handling procedures.

Is There a Penalty for Filing Late?

Not always. If the IRS owes you a refund, there’s no penalty for filing late. Penalties only apply if you owe taxes and miss the payment deadline.

You have three years from the original tax filing deadline to claim your refund. That means if you didn’t file your 2024 taxes (which were due in April 2025), you have until April 2028 to file and still get your money.

How Are Late Returns Processed?

The IRS processes late returns in the order they are received. Electronic returns usually take about 21 days to process. Paper returns take 4 to 8 weeks, depending on the IRS workload and whether the return needs further checks.

If you’re waiting for your refund, make sure all your information is accurate to avoid delays. Any mistakes in your return can slow down the process.

What Do You Need to Claim Your Tax Refund?

To file your return and claim your refund, you’ll need some key documents:

- W-2 forms (if you’re employed)

- 1099 forms (if you’re self-employed or have extra income)

- Receipts for deductible expenses, such as donations, tuition, or medical bills

- A valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- If married, your spouse’s SSN if filing jointly

- Details of your marital status (single, married, head of household, etc.)

- A copy of your previous return, if you used tax preparation software or a professional

Don’t worry if you don’t have paper copies—digital versions are usually accepted. The more complete your information is, the faster your refund will be processed.

Leave a Reply