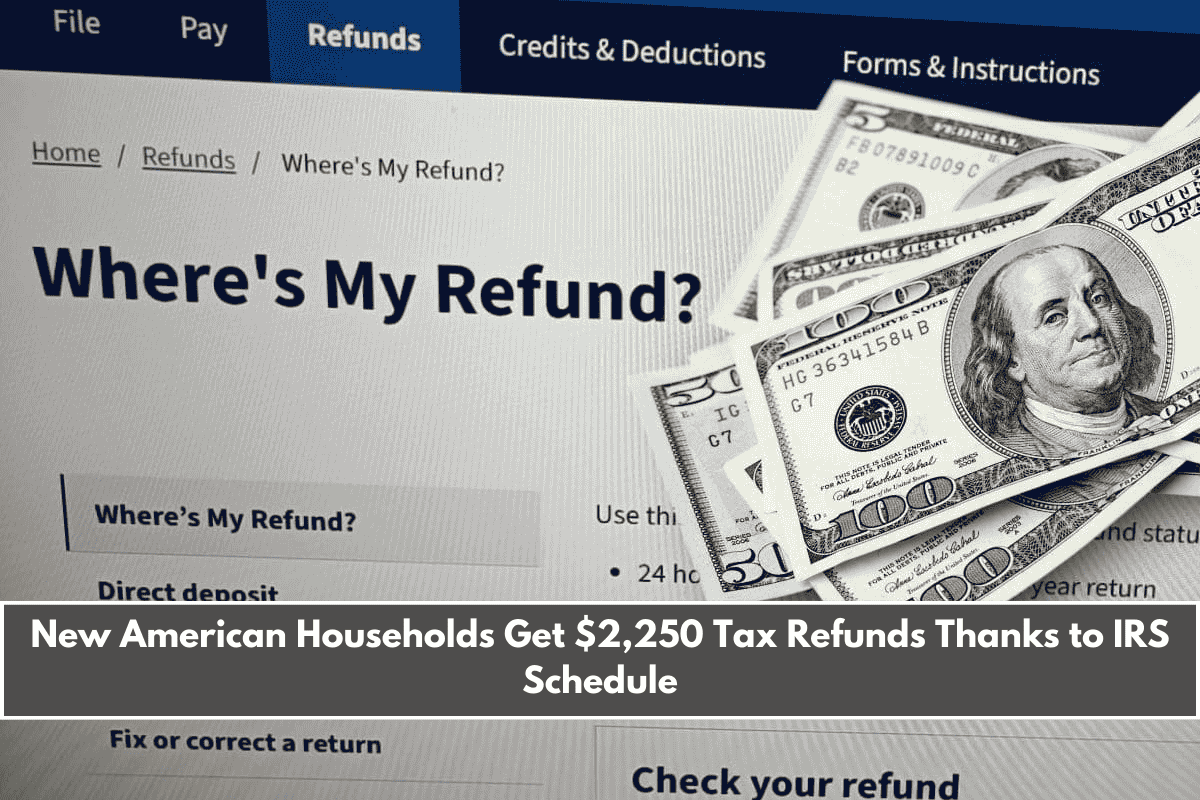

Thousands of Americans are eagerly waiting for their 2025 IRS tax refund, and the good news is that the Internal Revenue Service (IRS) is now speeding up the process by sending more checks to new groups of people. If you’ve already filed your tax return but haven’t seen your refund yet, don’t worry—it’s likely on the way soon.

How Tax Refunds Are Being Sent in 2025

The IRS is now working hard to send out a large number of tax refunds across the United States. Due to a backlog from early filings, some people are still waiting, but the delay shouldn’t last much longer. The tax refund process takes time because the IRS needs to review all your documents before approving and sending the payment.

Tax refunds are not guaranteed on a fixed date. Instead, they depend on when your tax return was filed. Generally, it takes about three weeks for the IRS to process and send your refund. However, if there are any issues with your documents or if your return was filed manually, it may take longer.

IRS Tax Refund Payment Dates Based on Filing Date

To help you get a better idea of when your refund might arrive, here’s a simple calendar showing estimated payment dates for people who filed their tax return between late February and early March:

Estimated Direct Deposit Dates:

If you filed on:

- February 24 – Expect deposit around March 17

- February 25 – Expect deposit around March 18

- February 26 – Expect deposit around March 19

- February 27 – Expect deposit around March 20

- February 28 – Expect deposit around March 21

- February 29 – Expect deposit around March 22

- March 1 – Expect deposit around March 23

- March 2 – Expect deposit around March 24

- March 3 – Expect deposit around March 25

- March 4 – Expect deposit around March 26

- March 5 – Expect deposit around March 27

- March 6 – Expect deposit around March 28

- March 7 – Expect deposit around March 29

- March 8 – Expect deposit around March 30

Keep in mind that these dates are just estimates. Processing times can vary depending on how busy the IRS is and whether there are any problems with your tax return.

Why Choosing Direct Deposit Matters

If you want to get your tax refund as fast as possible, choosing direct deposit is the smartest option. With direct deposit, your money goes straight into your bank account once the IRS approves the refund. If you haven’t set up direct deposit, your refund will come by mail, which could take several extra days.

Also, always make sure your bank details are correct when filing your return to avoid any delays in receiving your refund.

Leave a Reply