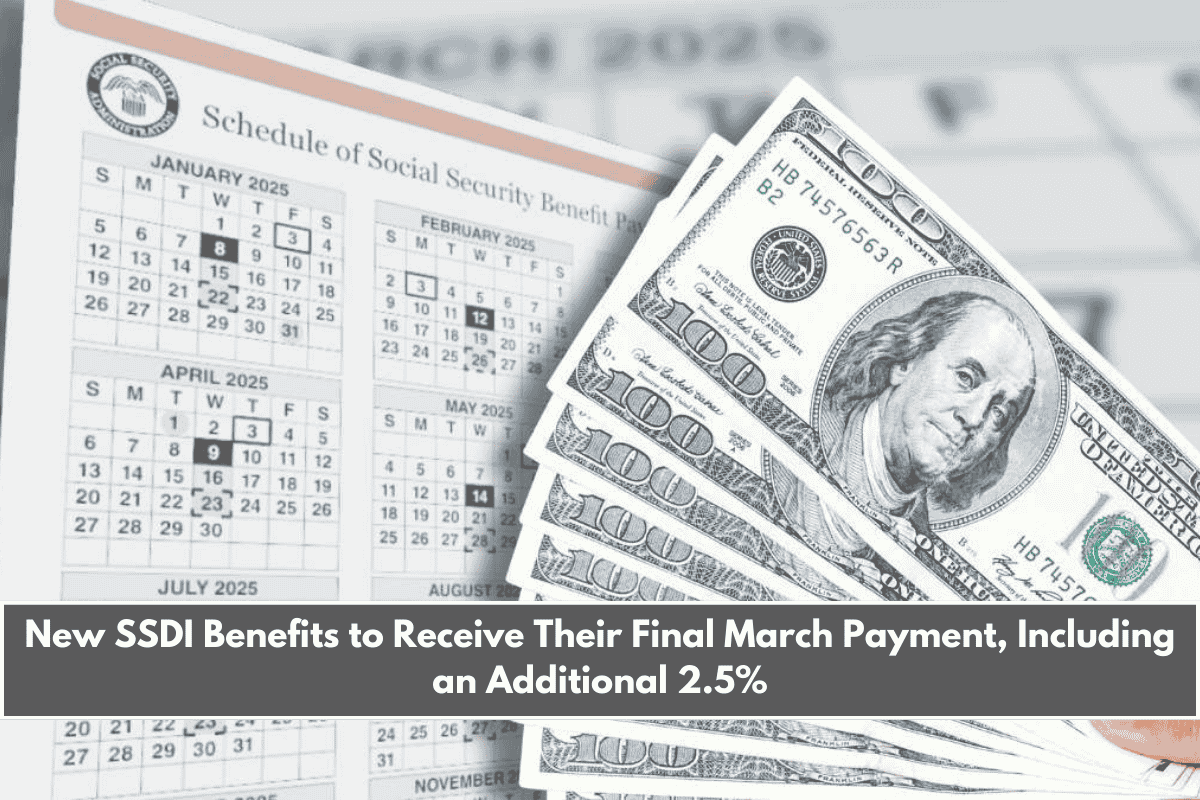

If you’re receiving Social Security Disability Insurance (SSDI) and also working in a disability-related field, it’s important to check your calendar this month. The Social Security Administration (SSA) sends payments each month based on your birth date. For many people, their March 2025 payment will arrive on the fourth Wednesday, which is March 26, 2025.

Each month, SSA organizes SSDI payments into three groups, based on the beneficiary’s date of birth. If your birthday falls between the 21st and 31st of any month, you’re in group three, and that’s when you’ll get your payment.

How Much Will You Receive?

In 2025, the average SSDI monthly payment is $1,580. However, some people may receive as much as $4,018 per month if they worked for many years and paid Social Security taxes on higher wages. These amounts include a 2.5% cost-of-living adjustment (COLA) added in 2025 to help keep up with inflation.

What Are the Requirements to Qualify for SSDI?

You can’t simply claim SSDI benefits by stating you have a disability. There are specific rules you need to meet to qualify.

Work Credits

To receive SSDI, you need to earn enough work credits through jobs where you paid Social Security taxes (FICA). Here’s how that works:

- For most people: You need 20 credits earned in the last 10 years, which is equal to about 5 years of work.

- For younger people: You may need fewer credits. For example, someone under 24 may only need 6 credits.

- In 2025, you earn 1 credit for every $1,810 you earn, up to a maximum of 4 credits per year. So, earning $7,240 in a year gets you the full 4 credits for that year.

Medical Requirements

Your disability must be serious enough to prevent you from doing any work that earns more than a set limit. This is called Substantial Gainful Activity (SGA).

In 2025:

- The SGA income limit is $1,620 per month for most people with disabilities.

- For people who are legally blind, the limit is $2,700 per month.

Types of Conditions Often Approved

Some medical conditions are more likely to get fast approval because of how severe they are. These include:

- Advanced cancer

- Multiple sclerosis (MS)

- Serious heart disease

- Major mental disorders (like schizophrenia)

- Severe spinal cord injuries

If your condition is not on SSA’s official list, they will check if it limits your ability to do any kind of job, not just your usual work. This is based on something called functional residual capacity.

Other Important Rules

To get SSDI, you also must:

- Be a U.S. citizen or qualifying immigrant with legal documents

- Be between 18 and 65 years old

- Not receive other Social Security benefits

After age 65, your SSDI benefits change into regular retirement benefits.

You are not eligible if:

- Your disability will last less than 12 months

- You don’t have enough work credits

- You earn more than the SGA monthly limit

Can Family Members Also Receive SSDI-Related Benefits?

Yes! If you’re receiving SSDI, some of your family members may qualify for extra benefits, such as:

- Children under 18 years old

- Spouses or ex-spouses caring for a disabled child under 18

- Spouses or ex-spouses who are over 62 years old

These benefits can make a big difference for families dealing with the challenges of disability.

Leave a Reply