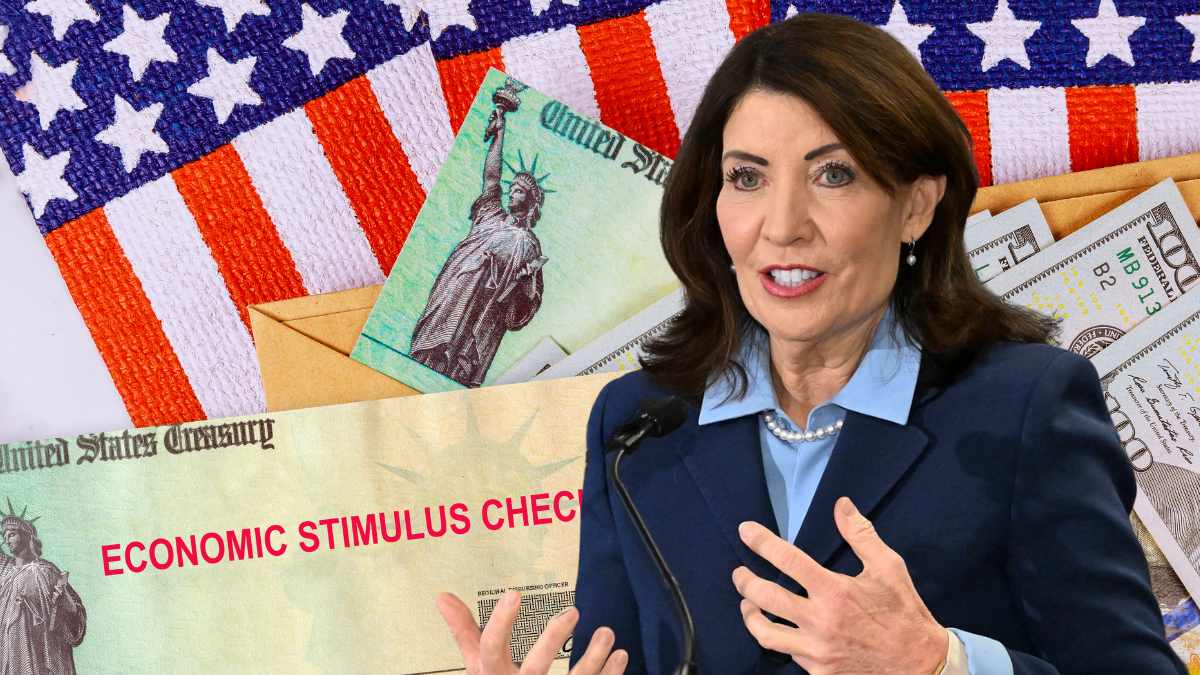

As inflation continues to strain American families, New York State has rolled out a bold new relief plan, offering direct stimulus payments to more than 8 million residents. The program, led by Governor Kathy Hochul, aims to support middle- and low-income households facing rising living costs.

With inflation numbers peaking at 9.1% in June 2022 and remaining high through 2025, this new plan is being called the “first of its kind” by state officials.

Who Qualifies for the New York Stimulus Check in 2025?

Under the new plan, eligible residents will receive one-time payments based on their income and filing status:

- Single taxpayers earning up to $75,000: $200

- Single taxpayers earning between $75,000 and $150,000: $150

- Joint filers with combined income up to $150,000: $400

- Joint filers earning between $150,000 and $300,000: $300

However, households earning over $300,000 jointly or over $150,000 individually are not eligible.

This plan is part of Governor Hochul’s strategy to ease financial pressure, especially in areas where the cost of living has hit record highs. Critics, however, see the move as political, coming ahead of a competitive election cycle.

Child Tax Credit Expanded: Up to $1,000 per Child

In addition to the stimulus checks, the state’s 2026 budget introduces major changes to New York’s Child Tax Credit. It now offers:

- $1,000 per year for each child under age 4

- $500 per year for each child aged 4 to 16

This expansion is expected to reach 2.75 million children across the state and will double the average family credit from $472 to $943 per year.

What’s more, middle-income families who previously didn’t qualify can now benefit. An estimated 187,000 additional children will be included under the new rules.

For example, a family earning $110,000 with two children (aged 3 and 10) will receive $1,500 annually, which is $1,000 more than before. Even a family earning $170,000, who previously earned too much to qualify, can now receive $500.

Why This Relief Matters in 2025

The stimulus checks and expanded tax credits come at a time when many New Yorkers are struggling to afford everyday needs. According to an April Marist poll:

- 46% disapprove of Governor Hochul’s performance

- 59% of voters prefer other political candidates

- 40% of Democrats are not supporting her re-election bid

Despite the criticism, Hochul defended the new policy by stating:

“Refunding nearly $5,000 to families means helping New Yorkers cope with the rising cost of food, raise children, and simply enjoy life.”

The full budget package includes:

- Up to $5,000 in total yearly benefits per household

- Free school meals for over 2.7 million students

- Lower taxes for middle-class residents

- Direct inflation checks based on income level

Previous Proposals and Other State Programs

In 2023, Hochul had suggested rebates of $500, though the amount was later reduced. The current program focuses on one-time payments, with no recurring checks promised.

Meanwhile, Georgia, under Republican Governor Brian Kemp, has introduced its own refund program. With elections nearing, some see these relief efforts as politically motivated.

New York officials have yet to confirm:

- How the payments will be sent (via check or bank transfer)

- Whether legislative approval is needed for funding

- When the digital platform for eligibility checks will go live

What to Expect Next

Authorities have announced that a digital platform will soon launch where residents can:

- Check eligibility

- Calculate personalized benefit amounts

- Track stimulus or credit status

This will help simplify the process and reduce confusion for families across the state.

Leave a Reply