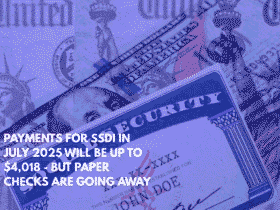

The United States Social Security Administration (SSA) has announced a significant update to Social Security payments for 2025, which includes a Cost-of-Living Adjustment (COLA) designed to keep up with inflation.

This increase is part of the Social Security Administration’s commitment to helping beneficiaries maintain their purchasing power in the face of rising living costs.

If you’re curious about the $1,580 and $1,976 Social Security payments, how to determine your eligibility, and what steps to take, this article has all the answers in an approachable yet expert tone.

$1,580 and $1,976 Social Security Payments Just Days Away

| Topic | Details |

|---|---|

| Payment Amounts | $1,580 for Disability Insurance (average), $1,976 for Retirement (average) |

| COLA Increase | 2.5% for 2025 |

| Payment Dates | Varies by birth date: Second, third, or fourth Wednesday of the month |

| Eligibility | Retirees, SSDI recipients, and survivors with sufficient work credits |

| Maximum Monthly Benefit | $4,018 for full retirement age; up to $5,108 for delayed retirement |

| SSA Website | Official resource for benefit updates and account management |

With the COLA increase for 2025, Social Security recipients will receive higher monthly payments, which will help to offset rising costs. Understanding your benefits is critical, whether you’re retiring, living with a disability, or receiving SSI.

What Are the New Social Security Payment Updates?

A 2.5% COLA adjustment will increase Social Security payments beginning in January 2025. This increase is part of the SSA’s annual effort to ensure beneficiaries’ purchasing power remains constant despite inflation. With inflation rising, this adjustment is more important than ever for retirees and disabled people who rely on Social Security for a significant portion of their income.

How Much Are the Payments?

- Retirees: The average monthly benefit will rise from $1,927 to approximately $1,976.

- Social Security Disability Insurance (SSDI): Payments will increase from $1,542 to about $1,580.

- Supplemental Security Income (SSI): Maximum federal payments for individuals will increase to $967, and for couples, up to $1,450.

Delaying benefits until age 70 can result in a monthly payment of up to $5,108. These changes ensure that Social Security remains a lifeline for millions of Americans who rely on it to cover basic expenses such as housing, healthcare, and groceries.

Why Does the COLA Matter?

The COLA ensures that Social Security benefits keep up with rising costs for goods and services. Without this adjustment, beneficiaries’ purchasing power would dwindle over time, making it difficult to maintain their current standard of living. The 2.5% increase is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Eligibility Requirements for $1,580 and $1,976 Social Security Payments

Eligibility depends on several factors, including your age, work history, and disability status. Here’s a breakdown:

For Retirement Benefits

- Work Credits:

- You need at least 40 work credits (approximately 10 years of work). Each credit is earned by accumulating a set amount of earnings ($1,640 in 2024 per credit).

- Age:

- Full Retirement Age (FRA) is 67 for individuals born in 1960 or later. You can claim reduced benefits starting at 62, but waiting until 70 maximizes your payments.

For SSDI

- Disability Requirement: A medical condition that meets the SSA’s definition of disability, which must be severe enough to prevent substantial gainful activity.

- Recent Work: Generally, you need to have worked at least 5 of the past 10 years before becoming disabled. Younger workers may qualify with fewer credits based on their age.

For SSI

- Income and Resource Limits: SSI is a need-based program, so income and assets are closely scrutinized. The resource limit is $2,000 for individuals and $3,000 for couples.

- Residency: Must be a U.S. resident or legal alien.

For personalized details, visit the My Social Security portal to check your eligibility and view your earnings record.

When Will You Receive Your Social Security Payments?

Your Social Security payment date depends on your birth date. Here’s the schedule:

| Birth Date | Payment Date |

|---|---|

| 1st – 10th | Second Wednesday of each month |

| 11th – 20th | Third Wednesday of each month |

| 21st – 31st | Fourth Wednesday of each month |

SSI recipients typically receive their payments on the first of each month, unless the date falls on a weekend or holiday. This staggered schedule helps to ensure that millions of beneficiaries across the country are processed efficiently.

How to Maximize Your Social Security Benefits

To get the most out of your Social Security payments, follow these strategies:

1. Delay Claiming Benefits

Every year you delay beyond your Full Retirement Age increases your benefits by about 8%, up to age 70. For example:

- Claiming at 67: $4,018 monthly maximum.

- Claiming at 70: $5,108 monthly maximum.

Delaying benefits is especially advantageous if you have a longer life expectancy or other sources of income to cover expenses in the meantime.

2. Coordinate Spousal Benefits

If you are married, consider spousal benefits and delayed retirement credits to increase your household income. For example, one spouse can claim a spousal benefit while the other postpones their own benefits to earn delayed retirement credits.

3. Continue Working

Each year you work increases your earnings record. Higher earnings may replace lower-earning years in the SSA’s calculation, boosting your benefit. Working longer hours also allows you to delay benefits, which increases the financial benefits.

4. Use the SSA Calculator

The SSA provides tools for estimating your future benefits. Try the Retirement Estimator. This user-friendly tool provides a detailed projection based on your current earnings history.

5. Optimize Taxes on Benefits

If you earn more than a certain amount, your Social Security benefits may be taxable. Strategically managing withdrawals from retirement accounts can help reduce your taxable income and lower the taxes you pay on your benefits.

Leave a Reply