You could be unknowingly leaving money on the table — and the deadline to claim it is just days away. The IRS is holding over $1.1 billion in unclaimed stimulus checks from 2021, and if you don’t act by April 15, 2025, that money will be lost forever.

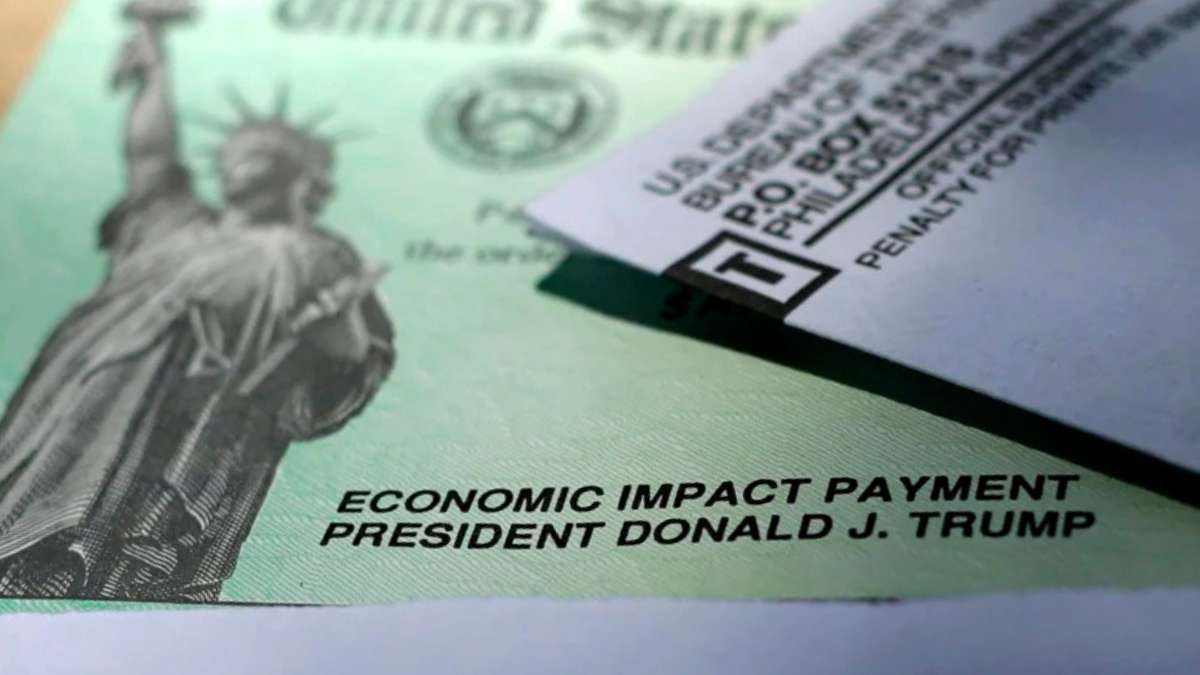

These are not new checks but pandemic-era payments that many people didn’t realize they were entitled to. If you never received the third round of Economic Impact Payments (EIP) — the one that included $1,400 per adult and dependent — you may still be able to claim it, but time is running out.

Who Can Still Claim Their 2021 Stimulus Payment?

The unclaimed checks are part of the American Rescue Plan signed in March 2021, which offered $1,400 per eligible adult and dependent child. While most people received this payment or claimed it through a Recovery Rebate Credit, the IRS found that nearly 1 million taxpayers never did.

This includes:

- People who didn’t file taxes in 2021 because they had no income or were unemployed

- People who filed incorrectly, leaving the rebate section blank or marked as zero

- People who were newly eligible for the payment and didn’t realize it

What to Do If You Haven’t Claimed It Yet

If you think you’re one of the people who never received the $1,400 payment, you still have a chance — but only if you file your 2021 tax return before April 15, 2025.

The IRS recommends:

- Creating or logging into your IRS online account

- Requesting W-2s or 1099s from previous employers or banks

- Asking the IRS for a transcript of your 2021 return if needed

Important: Late Filers Still Qualify

Even if you didn’t file taxes in 2021 because you had low income, no job, or were not required to file, you may still qualify for the payment. You just need to submit your 2021 tax return before the deadline.

Note: The IRS may withhold your refund if you haven’t filed tax returns for 2022 or 2023, or if you have outstanding federal/state debts.

How to Track Your Refund Status

Once you file:

- E-filing for current year: check refund status after 24 hours

- E-filing for previous years: check after 3–4 days

- Paper returns: expect a delay of about 4 weeks

What’s Causing the Delay?

The IRS has faced a challenging tax season due to:

- Budget cuts ordered by President Donald Trump and DOGE Secretary Elon Musk

- Over 6,000 employees laid off in February 2025

- Slower service and processing times despite digital tools

Although earlier funding from the Inflation Reduction Act of 2022 was meant to improve systems, recent downsizing has affected operations.

Final Reminder: Act Before April 15, 2025

If you’re owed the $1,400 stimulus payment from 2021, don’t delay. If you miss the deadline, your money goes to the Federal Reserve and cannot be recovered later. File your 2021 tax return now, even if your income was low or zero.

Leave a Reply